Digital Nomad Finances: Budgeting and Saving Tips for 2024

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are some budgeting tips for digital nomads for the year 2024?

Budgeting Tips for Digital Nomads 2024

Adjusting your lifestyle to be a digital nomad can mean reassessing your spending habits. Here are some budgeting tips for the digital nomad of 2024:

- Monitor and Track Your Expenses: Use digital platforms or applications to record your daily, weekly, and monthly expenses. Segregate them into categories like accommodation, food, travel, utilities, and entertainment to understand your main expenditure areas.

- Adjust According to the Cost of Living: Not all countries or cities will have the same cost of living. Adjust your budget to account for these variations.

- Create an Emergency Fund: Unexpected expenses can arise anytime, especially while traveling. It's essential to have a separate emergency fund.

Saving Tips for Digital Nomads 2024

Savings are crucial for anyone, especially for digital nomads as they have variable income and living conditions. Below are some saving tips you may consider:

- Limit Dining Out: Eating out often can eat up a significant portion of your budget. Consider preparing meals at home or opting for places with kitchen facilities.

- Travel Slow: Instead of hopping from one place to another, stay longer in one location. This tip can significantly reduce your travel expenses.

- Consider Shared Spaces: Shared living spaces or coworking spaces can help you save a lot as compared to renting individual accommodations or offices.

Financial Planning Table

This simple table provides a rough breakdown that can help you plan your digital nomad budget for 2024.

| Categories | Percentage of Income |

|---|---|

| Housing | 30% |

| Food | 20% |

| Transit | 10% |

| Entertainment | 10% |

| Emergency Fund | 10% |

| Savings | 20% |

2. How can digital nomads save more money while traveling in 2024?

Adopting Money-Saving Strategies

For digital nomads looking to save money while traveling in 2024, implementing a strategic approach is essential. First, consider accommodation options that offer value for money. Rather than staying at hotels, opt for long-term rentals, shared accommodations or house-sitting opportunities. Use comparison websites to find the best deals available. Second, cook your meals instead of eating out where possible. Finally, local marketplaces can be cost-effective venues for not only buying groceries but also for immersing in local experiences.

Eliminating Unnecessary Expenditures

Examining your spending habits in detail can help discover areas where cutbacks can be made. Unnecessary spending can kill your budget, so remember to:

- Avoid impulse buying. Resist the urge to buy souvenirs or items you don’t need.

- Limit your nightlife activities. Partying or dining out frequently can rapidly drain your funds.

- Use public transportation instead of taxis or rideshares where safe and feasible. Consider walking or cycling for short distances.

Financial Tools for Monitoring and Saving

In 2024, digital nomads have access to various financial tools and apps designed to monitor spending and facilitate savings. Using these tools, you can track and categorize your expenses, set a budget, and implement savings goals. Example of some popular apps include:

| App Name | Key Features |

|---|---|

| Mint | Budgeting Tools, Bill Tracking, Credit Score Monitoring. |

| YNAB (You Need A Budget) | Personal Budget & Finance Software, Debt Paydown tools. |

| Acorns | Automated Saving, Invests Spare Change. |

3. Where should digital nomads invest their money in 2024 to get the maximum returns?

Choosing the Right Investment Avenues

Understanding the digital nomad lifestyle's constraints and freedoms, you need to carefully choose where to invest your money. In the coming year, there are a few sectors that stand out as promising investment destinations.

- Cryptocurrencies: With increasing digitalization and acceptance of cryptocurrencies across the globe, investing a part of your savings in cryptos like Bitcoin, Ethereum, etc., could prove to be lucrative. However, due to their known volatility, you must understand and manage the imposed risks carefully.

- Stock Market: Stocks and ETFs remain a lucrative option for nomads. Reputed online brokerage platforms allow you to trade regardless of your location.

- Real Estate Crowdfunding: For digital nomads attracted to the real estate market but intimidated by onsite management, Real Estate crowdfunding platforms democratize property investment.

Maximizing Investment Returns

To maximize your returns, smart and strategic investing is crucial. The following tips may come in handy:

- Diversification: Spreading your investments across different asset classes will minimize risks and optimize returns.

- Robo-advisors: These automated financial planners are accessible, cost-effective, and come with the bonus benefit of helping manage taxation, thus proving ideal for digital nomads.

- Regular Investments: Regularly investing, or Dollar-Cost Averaging (DCA), rather than one-time lump sum investments can help to mitigate timing risks.

Displays of Average Return Rates

The table below provides an overview of the estimated average return rates for the investment options mentioned above:

| Investment Option | Average Annual Return Rate |

|---|---|

| Cryptocurrencies (Highly Variable) | 5% - 200% |

| Stock Market (S&P 500) | 10% |

| Real Estate Crowdfunding | 8% - 15% |

Please remember that returns on investment are always subject to market volatility, making it crucial to conduct thorough research and consider consulting with a financial advisor before making investment decisions.

4. What budgeting apps are best for digital nomads in 2024?

Top Budgeting Apps for Digital Nomads in 2024

In today's world of technological advancements, several budgeting apps have transformed the way digital nomads manage their finances. These apps help remote workers track their income and spending, saving for future plans and ensuring financial security. Here, we look at three top-rated budgeting apps perfect for digital nomads in 2024:

- Mint: Mint, developed by Intuit, is a popular app among digital nomads for its extensive features. It offers budgeting tools, bill tracking, credit score checks, and savings goals among others. The app also integrates numerous financial accounts for a comprehensive view of your financial status. Mint is free to use, making it an economical choice for budgeting.

- You Need A Budget (YNAB): YNAB operates on a philosophy of giving every dollar a job, ensuring users have a plan for each cent they earn. This app is known for its detailed budgeting approach and financial education resources. While it comes with a small monthly fee, it often pays for itself by helping users save money effectively.

- PocketGuard: PocketGuard simplifies budgeting by offering users an understanding of how much they can spend on any given day, after accounting for bills, goals, and recurring expenses. The app categorizes transactions and offers insights into where you may be overspending.

Comparing the Budgeting Apps

To better assist you in choosing the appropriate app, here's a table highlighting the distinctive features, pricing, and benefits of each:

| App | Features | Pricing | Benefits |

|---|---|---|---|

| Mint | Budgeting tools, bill tracking, credit score checks, savings goals | Free | Comprehensive financial overview, economical |

| YNAB | Detailed budgeting approach, educational resources | Monthly subscription | Promotes smart spending habits, excellent for learning about finance |

| PocketGuard | Daily spending limit, transaction categorization, spending insights | Free, with optional in-app purchases | Eases budgeting process, identifies potential overspending |

Choosing the Right App Based on Personal Needs

The choice of a budgeting app largely depends on your personal financial needs and goals. While Mint provides a holistic view of your finances, YNAB is exceptional for learning and building strong financial habits. On the other hand, PocketGuard is ideal for simplifying budgeting. Therefore, choose an app that aligns with your goals and complements your lifestyle as a digital nomad.

5. How can digital nomads best plan their finances for 2024?

Financial Planning Strategies for Digital Nomads in 2024

The lifestyle of a digital nomad can be quite appealing with its flexibility, freedom, and the ability to work from anywhere. However, this lifestyle can also come with uncertainty, particularly in terms of finances. Therefore, to ensure financial security in the year 2024, digital nomads should employ some smart financial strategies.

- Create a Budget: The first step to financial planning is to establish a budget. This should incorporate every aspect of your lifestyle from rent, utilities, food, healthcare, leisure activities, investments and emergency funds. Knowing what you spend each month can help you control your finances and prevent overspending.

- Choose the Right Bank: Seek a bank with favorable terms for travelling, such as no foreign transaction fees and a dependable customer service.

- Invest in Health Insurance: Having a good health insurance plan should be an important part of planning as healthcare prices vary country to country. Look for internationally recognized health insurance.

- Develop a Retirement Plan: Just because you're a digital nomad doesn't mean you should forget about retirement. There are many retirement plans accessible to self-employed people that could help you in the long run.

- Save for Emergencies: An emergency fund is crucial. Since income can be unpredictable as a digital nomad, it's important to have a safety net in case of unexpected expenses.

Example of a Monthly Budget for a Digital Nomad

Creating a budget is an essential part of financial planning. Here's an example of what a monthly budget could look like for a digital nomad in 2024:

| Expense | Cost |

|---|---|

| Rent | $600 |

| Utilities | $100 |

| Food | $300 |

| Health Care | $200 |

| Leisure Activities | $150 |

| Investments | $200 |

| Emergency Fund | $250 |

| Total | $1800 |

However, everyone's budget will be different, depending on personal lifestyle, travel locations, and spending habits. It is important to reassess your budget regularly as a digital nomad, as your costs can greatly vary depending on the country you are in.

6. Are there specific financial pitfalls digital nomads should be aware of in 2024?

Common Financial Pitfalls for Digital Nomads

As digital nomads embrace a location-independent lifestyle, they should also be vigilant about potential financial pitfalls in 2024. These can range from overlooked taxes, high costs of living in certain countries to currency fluctuation risks:

- Tax liabilities: It's crucial to understand your tax obligations in both your domicile and host countries to avoid non-compliance that can lead to hefty fines.

- High cost of living: Some popular digital nomad destinations can have a high cost of living. To survive, you should be knowledgeable about the cost of housing, food, transportation, and other common expenses.

- Currency Fluctuation: Digital nomads also face the risk of their income losing value against local currencies, especially if they earn in a different currency from the local one.

Impact of Pitfalls on Digital Nomad Finances

To illustrate the potential financial impact of these pitfalls on digital nomads budgeting and saving in 2024, consider the following table:

| Pitfall | Potential Impact |

|---|---|

| Tax Liabilities | Failed tax compliances could lead to fines and penalties that can greatly affect one's budget and saving plans. |

| High Cost of Living | Living expenses over your budget could lean into your savings, making it difficult for you to accomplish your financial goals. |

| Currency Fluctuation | Unfavorable currency exchange rate could lessen your purchasing power or increase costs, directly impacting your budget and savings. |

Preventing Financial Pitfalls

Prevention is better than cure, and this holds true for managing these financial pitfalls. Here are some suggestions for proactive solutions:

- Stay informed: Keep updated about tax regulations in all countries you work from, and consider consulting a tax consultant for personalized advice.

- Plan and Budget: Before moving to a new location, research the cost of living and draw a realistic budget to guide your spending.

- Hedge against currency risks: Nomads could consider keeping savings in multiple currencies, using financial instruments that hedge against currency risks, or selecting platforms that offer optimal currency conversion.

7. How can digital nomads manage their taxes while traveling in 2024?

Understanding Tax Liability

As a digital nomad, it's crucial to understand your tax liability to ensure you're complying with all necessary regulations. Firstly, tax liability often depends on your country of residence. In many cases, even if you're traveling internationally, you may still be required to pay taxes in your home country. If you are a U.S. citizen, for instance, you are taxed on worldwide income regardless of where you live. Countries like the UK and Australia apply similar rules. Check the tax laws in your home country and ensure you are up to date with changes as of 2024.

- USA: Global income taxable

- UK: Global income taxable unless classed as non-resident

- Australia: Global income taxable if classed as resident for tax purposes

Tax Treaties and Foreign Earned Income Exclusion

In some situations, digital nomads may avoid paying taxes twice on the same income due to tax treaties or mechanisms such as the Foreign Earned Income Exclusion (FEIE) for U.S. citizens. FEIE allows qualifying individuals to exclude a certain amount of their foreign earned income from U.S. taxes. It's wise to familiarize yourself with these tax mitigating provisions. The following table shows FEIE limits in recent years.

| Year | FEIE Limit |

|---|---|

| 2021 | $108,700 |

| 2022 | Projected to further increase |

Employing a Virtual CFO or Tax Professional

To effectively manage taxes in 2024, it may be beneficial to employ a virtual CFO or tax professional familiar with international tax law. These specialists can help ensure you're not missing any crucial information, deductions, or credits that could reduce your tax liability. In addition, they can help you put effective systems in place for proper record keeping, make sure you’re maximizing retirement contributions, and ensure that you understand your tax obligations in clear terms. While this will require an investment, the reduced stress and potential savings may outweigh the costs.

8. What are the expected costs digital nomads should budget for in 2024?

Living Expenses and Business Costs

One major cost any digital nomad will incur will be living expenses, which tend to vary significantly depending on their country of choice. These living expenses may include:

- Housing: Either hotel costs, rental or co-living spaces.

- Food: groceries or restaurant meals.

- Transportation: Public or private transportation costs within a city or between cities/countries.

Business costs may include:

- Co-working space fees

- Internet/data

- Technology and software subscriptions

- Insurance

Travel and Health Expenses

Digital nomads should anticipate expenses such as:

- Flights: Digital nomads travel quite frequently, and so travel expenses are a significant part of their budget.

- Travel insurance: While not always mandatory, travel insurance is invaluable for any unexpected incidents.

- Health insurance: Depending on the country, a digital nomad may have to invest in health insurance.

- Visa fees: Some digital nomads may require visas, which also cost money.

Cost Table

| Category | Expected Monthly Cost |

|---|---|

| Housing | $300 - $800 |

| Food | $200 - $400 |

| Transportation | $100 - $300 |

| Co-working space fees | $100 - $300 |

| Internet/data | $50 - $100 |

| Flights | $300 - $500 |

| Travel insurance | $50 - $100 |

| Health insurance | $100 - $200 |

| Visa fees | $20 - $90 |

Please be aware that these are just approximations and actual costs can widely vary based on different factors such as location, lifestyle and personal health conditions.

9. What ways can digital nomads diversify their income streams in 2024?

Income Diversification for Digital Nomads

Boosting financial security as a digital nomad isn't just about saving, it also relies on diversifying your income streams. Here are a few income diversification methods that can prove successful in 2024:

- Remote Job: Remote work remains the most common income stream for digital nomads. But remember, it doesn't have to be one full-time job. Part-time gigs or multiple project-based tasks can provide stability and flexibility.

- Passive Income: Passive income-generating activities like renting out properties, dividends from investments, royalties from creative works can serve as a steady income stream.

- Product Creation: Create your own physical or digital product. This could be an e-book, online course, or even physical goods like handmade jewelry.

- Affiliate Marketing: One way to make extra money online is promoting other companies' products and earning a commission for any sales made through your referral links.

- Consulting or Coaching: Use your skills and experience to offer consulting or training services online.

Comparative Earnings of Income Streams

To provide a better view, let's take a look at the potential profitability of each proposed income stream in comparison to one another:

| Income Stream | Median Monthly Earnings (USD) |

|---|---|

| Remote Job | $3,000 |

| Passive Income | $1,000 |

| Product Creation | $2,500 |

| Affiliate Marketing | $1,500 |

| Consulting or Coaching | $3,500 |

Implementing Diversification Strategies

Starting to create diverse income streams can be as simple as investing a small portion of your time to learning new skills, setting aside small amounts of your monthly earnings into passive income streams, or expanding your current work into something more. It is important to remember, however, that diversification strategy may vary greatly due to individual skills, interests, availability of resources, etc. Therefore, personal evaluation and research is crucial before delving into various income avenues.

10. How can digital nomads save on accommodation and travel expenses in 2024?

Saving on Accommodation

Digital Nomads can save significantly on accommodation costs in various ways:

- Long-term Rental: Opting for monthly rental contracts rather than daily or weekly arrangements can bring down the cost remarkably.

- House/Pet Sitting: Sites like TrustedHouseSitters connect digital nomads with homeowners who need someone to look after their homes or pets while they are away.

- Shared Accommodation: Sharing accommodation with fellow digital nomads can be a wallet-friendly way to stay in top locations.

Saving on Travel Expenses

Cost-efficient travel is crucial for a digital nomad. Here are some useful strategies:

- Use of Miles and Points: Make sure to maximize airline frequent flyer programs or credit card travel rewards.

- Off-Peak Travel: Flying during the off-peak season or on weekdays can result in substantial savings.

- Carry-on Only: Avoiding check-in luggage can reduce your airfare, save time, and eliminate the risk of lost baggage.

Cost Optimization Table

You can refer to the cost optimization table to better budget your expenses:

| Expense Categories | Options | Pros & Cons |

|---|---|---|

| Accommodation | Long-term rental, House/Pet sitting, Shared Accommodation | May be cheaper in the long run but lacks flexibility |

| Travel | Use of Miles and Points, Off-Peak Travel, Carry-on Only | Saves money but requires advanced planning and restrictions |

Conclusion

Mastering Digital Nomad Finances

Living as a digital nomad brings the freedom to work from virtually anywhere. However, it also necessitates careful budgeting and saving to sustain such lifestyle.

As digital nomads, you need to plan for costs such as accommodation, food, and transport, plus the need to save for emergency fund, retirement, insurance, and even taxes. Below are some tips to help you navigate your finances in 2024 and beyond.

Set Clear Financial Goals

Start by identifying what you want to accomplish with your finances. This could include retirement savings, emergency fund, or even a dream vacation.

Create a Budget

Outline your income and expenses, and track every cent you earn and spend to avoid overspending.

Open a High-Yield Savings Account

A high-yield savings account allows you to grow your money at a faster rate.

Invest Wisely

Invest in assets that can grow over time, like stocks or real estate.

Use Financial Management Tools

Employ financial management tools like Retainr.io to help you manage your finances.

Retainr.io is a whitelabel software designed to manage client orders and payments with your own branded app. Sell, manage clients, orders and payments like never before and ensure your digital nomad finances are on track.

Keep an Eye on Exchange Rates

Pay close attention to currency exchange rates if you’re earning and spending in different currencies.

Finally, remember to regularly assess your financial plan and adapt it to your changing needs and circumstances. Remember, discipline and persistence are the keys to successful budgeting and saving.

Bring your digital nomad experience to a whole new level with Retainr.io. Try it today!

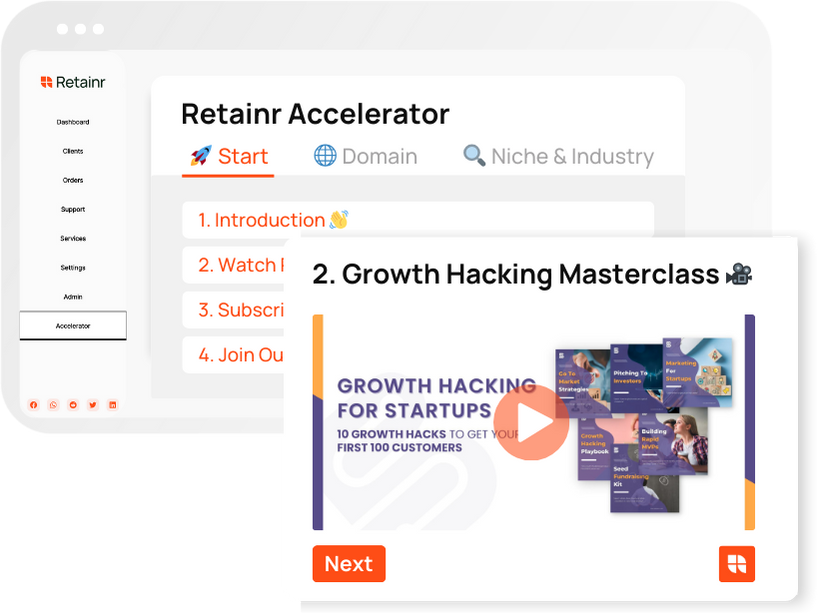

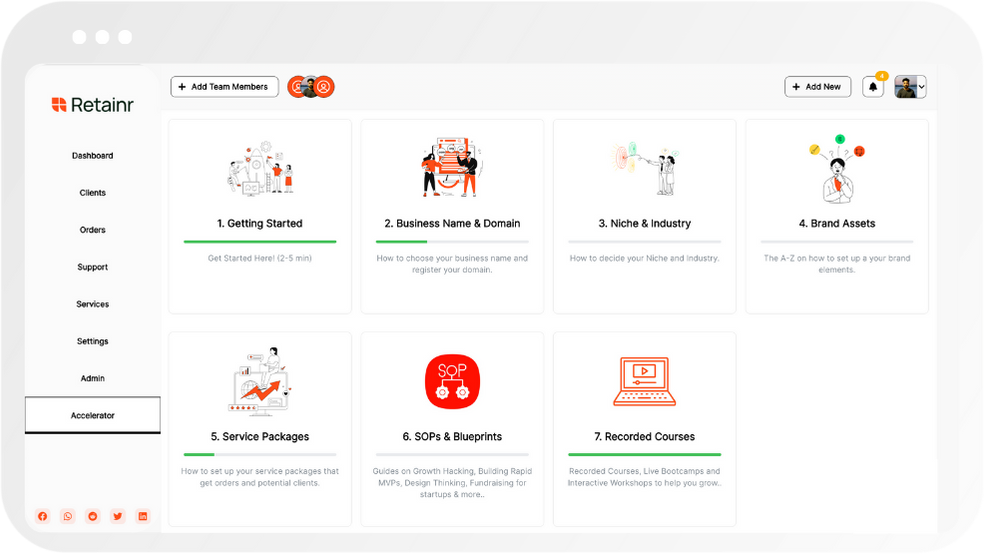

Boost Your Agency Growth

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)