7 Clever Budgeting Tips for Freelance Entrepreneurs

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are 7 clever budgeting tips for freelance entrepreneurs?

Budgeting Tips for Freelance Entrepreneurs

Keeping your finances in check is crucial as a freelance entrepreneur. Good budgeting habits not only let you manage money better but also help you plan for future expenses. Here are seven clever budgeting tips every freelance entrepreneur should follow:

- Always Have a Cushion Fund: Set aside an emergency fund. This fund would work as a financial cushion for months when the income might dip.

- Track Your Expenses: Keep an eye on every expense, no matter how small. Apps like Mint or Expensify can help you with this task.

- Plan for Taxes: As a freelancer, you're responsible for your own taxes. Setting aside a specific part of your income for taxes can save you from financial stress later.

- Invest in Your Business: Allocate a certain portion of your budget to business expansion and professional growth. This includes advertising, courses, certifications, etc.

- Limit Personal Expenditures: Since your professional and personal finance gets intertwined, limiting personal expenditure can free up more funds for the business.

- Set Clear Financial Goals: This ensures you stay focused and don’t fall into a debt trap by spending unnecessarily.

- Adjust Your Budget Regularly: A static budget doesn't work for freelancers due to the unpredictability of their income. Reviewing and adjusting your budget frequently is crucial.

Recommended Budget Allocation for Freelancers

Apart from clever tips, having a clear idea about how much to spend where can make budgeting easier. Here is a tabular representation of suggested budget allocation for freelance entrepreneurs:

| Categories | Percentage Allocation |

|---|---|

| Essential expenses (rent, food, utilities) | 50% |

| Professional Expenses (tools, advertising) | 20% |

| Savings & Investments | 20% |

| Non-essential expenses (hobbies, entertainment) | 10% |

Wrapping Up

As a freelance entrepreneur, budgeting is about more than just tracking income and expenses. It's about creating a plan for your money, sticking to that plan, and then adjusting it as necessary. With the strategies outlined above, financial management can become a much simpler and stress-free process, thereby paving the way for more business growth and personal financial stability.

2. How can freelance entrepreneurs better manage their budget?

Implement Detailed Tracking

For freelance entrepreneurs, it's crucial to master the art of detailed tracking. Start by monitoring all your income sources carefully. Not just the amount, but also when, from whom, and for what service it comes from. Equally important is scrutinizing your expenses. Understand where every penny goes. This could be supplies, marketing, taxes, rent, or even those cups of coffee during client meetings.

- Income

- Amount

- Source

- Date

- Service rendered

- Expenses

- Supplies

- Marketing

- Taxes

- Rent

- Miscellaneous (like coffee during client meetings)

Use Budgeting Tools

Next, implementing use of budgeting tools can greatly simplify the process of managing finances. There are a variety of apps and software available including Quickbooks, Freshbooks, and Mint. These tools can help with invoice management, expense tracking, and even provide financial reports that give an overview of your financial health.

| Tool | Use |

|---|---|

| Quickbooks | Comprehensive financial management |

| Freshbooks | Invoice management and expense tracking |

| Mint | Personal finance and budget tracking |

Plan for Periods of Feast and Famine

Lastly, one of the challenges of freelancing is the unpredictable cash flow. Some months can be incredibly lucrative, while others might be lean. It's therefore wise for freelance entrepreneurs to anticipate these fluctuations and plan for both scenarios. During profitable months, resist the urge to splurge and instead set aside money for the less fruitful periods.

3. Are these budgeting tips applicable to all types of freelance businesses?

Applicability of Budgeting Tips for Various Freelance Businesses

The given budgeting tips are practical and implementable for multiple types of freelance businesses. The universality of these tips stems from their focus on basic concepts of income management, expense tracking, and financial planning. Regardless of your industry, getting a handle on these aspects is key to business success.

- Income Management: Be it freelance writing, graphic designing, or consulting work, every freelancer gets income from varied sources over irregular intervals. Tips like setting a realistic budget and considering income fluctuations hence apply to all.

- Expense Tracking: Keeping a tab on necessary expenses such as equipment, software subscriptions or travelling costs is crucial for all freelancers. By implementing tips like maintaining an emergency fund, freelancers can better manage unforeseen costs.

- Financial Planning: Regardless of the nature of the freelance work, creating a financial cushion and setting long-term goals are universally beneficial strategies. Saving for retirement is a crucial aspect that every freelancer should consider.

Budgeting Tips and different Freelance Businesses

The table below showcases how different freelance businesses can implement these budgeting tips:

| Freelance Business | Budgeting Tip |

|---|---|

| Freelance Writing | Keep a buffer for dry periods when assignments are rare. |

| Graphic Designing | Invest in necessary software upfront and consider it in initial expenses. |

| Consulting | Set a budget considering potential client meetings and travel costs. |

The flexibility and diversity inherent to freelancing mean that each entrepreneur’s financial journey is unique. It is essential, therefore, that each individual customizes these general budgeting tips to align with their specific circumstances and freelance business model.

4. How can these budgeting tips help in reducing financial stress for freelancers?

Improved Financial Management

Implementing budgeting tips like creating a financial plan, having a regular review of your finances, and setting aside money for taxes can significantly improve financial management. A good financial plan will provide a clear picture of real-time income, fixed expenses, and variable expenses. This planning helps in allocating funds optimally and ensuring that every dollar is accounted for, leading to fewer financial worries. Regular reviews allow you to maintain a close eye on your cash flow and timely adapt to changes, curbing any unexpected financial stress.

- Create a financial plan

- Have a regular review of your finances

- Set aside money for taxes

Future Financial Security

Saving for a rainy day and diversifying income streams can ensure financial security in the future. By setting aside a certain percentage of income into an emergency fund, you can have a safety net for unforeseen circumstances, such as losing a major client. This safety net could help you tide over financial stress during such tough times. Further, diversifying income can create additional revenue sources, reducing the dependency on a single client, and hence, the fear of financial instability.

| Strategies | Benefits |

|---|---|

| Saving for a rainy day | Provides financial safety net for unforeseen circumstances |

| Diversifying income streams | Creates additional revenue sources, reducing financial stress |

Enhanced Control Over Finances

Effective budgeting tips, such as cutting back on unnecessary expenses and timely payment of bills, help freelancers have more control over their finances. Reducing unnecessary expenses can lead to significant savings that can be utilized better. Timely payment of bills helps avoid any late payment fees and keeps your credit score healthy, thereby reducing financial stress.

- Reduce unnecessary expenses

- Pay bills on time

5. How can budgeting improve the profitability of a freelancer’s business?

Importance of Budgeting for Profitability

Profitability is the central goal of any business, and for a freelancer, effective budgeting is one of the key strategies to achieve this goal. By carefully monitoring and managing your income and expenses, you can maximize your profitability in several ways.

- Reduced unnecessary expenses: When you create a budget, you get a clear picture of where your money is going. This allows you to pinpoint and cut back on non-essential expenses.

- Efficient resource allocation: A budget helps you allocate your resources more efficiently. It aids you in making decisions about what projects to take on and what expenses you can afford.

- Enhanced financial control: Knowing exactly what's coming in and going out of your business allows you to make strategic decisions. It gives you the control to steer your business in the direction you want.

Profits, Costs, and Budgeting Table

The table below illustrates how profitability correlates with costs and budget management.

| Category | Without Budgeting | With Budgeting |

|---|---|---|

| Profit | Unpredictable. Without a budget, you may end up spending more than you earn. | Predictable and likely higher. A well-managed budget helps keep expenses in line and promote surplus income. |

| Costs | Possibly high and uncontrolled. Lack of planning can lead to unnecessary expenses. | Minimum and controlled. A budget compels you to allocate funds effectively, minimizing unnecessary costs. |

| Risk | High. Without a budget, unexpected costs or low income periods pose a higher risk. | Lower. With a budget, you are better prepared for lean times, protecting your profitability. |

Improvement in Profitability

To maximize profitability, freelance entrepreneurs should apply disciplined budgeting practices. A well-planned budget enables you to invest in opportunities that drive growth, like marketing initiatives or software upgrades. It provides a safety net for unexpected expenses, reducing financial stress. Moreover, regular budgeting allows you to identify financial trends, inefficiencies and potential cost savings, leading to improved profitability over time.

6. Can these budgeting tips help in balancing irregular income of freelance entrepreneurs?

Managing Irregular Income Through These Budgeting Tips

Freelance entrepreneurs often contend with irregular income flow which presents unique financial management challenges. However, these budgeting tips can significantly aid in bringing balance and predictability to unpredictable income patterns. Accordingly, this often leads to better fiscal stability and control, making the freelance entrepreneurial journey smoother.

Budgeting Tips for Balancing Irregular Income

- Create a Baseline Budget: A freelance entrepreneur should establish a baseline budget founded on their lowest income month within the past year. This strategy guarantees maturing bills, irrespective of whether they've had a slow month.

- Set Aside for Taxes: As there usually isn't a standard tax withholding system for freelance entrepreneurs, setting aside a percentage of each paycheck for taxes is crucial. This allocation can be made into a separate savings account.

- Emergency Fund: Establishing an emergency fund safeguards against financial hardship during lean months. Economists generally recommend that this fund should equate to three to six months of living expenses.

- Regularly Review and Adjust Budget: Regular reviews can spot trends, highs, and lows allowing for appropriate budgetary adjustments.

- Utilize budgeting tools: Plenty of budgeting apps and tools like Mint, PocketGuard, and YNAB offer real-time budget tracking.

- Think twice before big expenses: Before embarking on big purchases, evaluate its necessity, and where possible, opt for cost-effective alternatives.

- Learn to say no: Not every gig or business opportunity should be accepted. Consider the payout, overall value, and how it fits into your long-term goals before accepting.

How Budgeting Tips Aligns with Monthly Revenues and Expenses

The following table provides an overview of how the above budgeting tips can be practically applied over three months:

| Month | Revenue | Expenses | Net | Budgeting Tip |

|---|---|---|---|---|

| January | $2,000 | $1,500 | $500 | Use extra funds to boost emergency fund |

| February | $1,500 | $1,500 | $0 | Avoid big expenses and focus on necessary costs |

| March | $3,000 | $1,500 | $1,500 | Set aside increased portion for taxes and invest in revenue increasing opportunities |

7. What are some practical ways for freelancers to stick to their budget?

Practical Ways for Freelancers to Stick to Their Budget

Sticking to a budget requires discipline and rigor. However, certain strategies can simplify this task immensely. Some useful tactics that freelancers can implement to be more stringent budget followers include:

- Automating Savings: This is one of the simplest ways to ensure a portion of the income goes into savings. Many banking platforms offer the option to automatically transfer funds to the savings account from the primary account periodically.

- Using Budgeting Tools: There are numerous budgeting apps available which can aid freelancers in keeping track of their income and expenses. These bring convenience and insight by categorizing and analyzing spending habits.

- Setting Clear Financial Goals: Having a clear goal, whether it's for a long-term project or immediate needs, can motivate individuals to control overspending.

Furthermore, freelancers need to be realistic about their expenses and potential earnings. To have a comprehensive understanding, keeping a log of income and expenses is necessary:

| Income | Expense |

|---|---|

| Project fees received | Rent or mortgage |

| Recurring passive income | Utilities |

| Residual income from previous projects | Travel expenses |

Once they have a clear picture of their financial position, freelancers can make informed decisions to adjust their budget, spending habits, or income strategies. By doing so, they can ensure they stick to their budget efficiently and effectively.

8. How can these budgeting tips help freelancers in financial forecasting?

Understanding the Impact of Budgeting on Financial Forecasting

Budgeting is an incredibly effective tool for freelance entrepreneurs. Practising these budgeting tips can assist freelancers in financial forecasting in several ways. The first is that it can provide predictability. By carefully tracking income, expenses, and savings, freelancers can accurately project their financial stability for upcoming months. Secondly, it is important for trend identification. Regular budgeting can help freelancers identify patterns and trends in their income and expenses, which can be invaluable for accurate financial forecasting.

Key Budgeting Strategies and their Role in Financial Forecasting

- Regularly Review Finances: Regular reviews can highlight where freelancers are overspending and where they can save. By staying on top of their financial situation and making necessary adjustments, they can forecast how these changes could impact their finances in the future.

- Keep Track of Earnings: By keeping a close eye on their earnings, freelancers can accurately predict their income in coming months based on previous earnings patterns. This can help with future planning and investment decisions.

- Plan for Unexpected Expenses: Freelancers should always have a reserve budget for unexpected costs. By setting aside money each month, they can protect their future financial stability.

Visualizing Financial Forecast through Tables

A table is an excellent resource for visualizing financial forecasts. For instance, a table can be used to compare past and present income, expenses, and savings. This allows for easier comparisons and trend identification. Here is an example:

| Month | Income | Expenses | Savings |

|---|---|---|---|

| January | $2000 | $1500 | $500 |

| February | $2200 | $1600 | $600 |

| March | $2100 | $1700 | $400 |

By analyzing the data, freelancers can get a clear picture of their financial trajectory, allowing for better financial forecasts.

9. Can these budgeting tips help freelancers deal with late payments from clients?

Effect of Budgeting Tips on Dealing with Late Payments from Clients

These budgeting tips are not only designed to help freelance entrepreneurs in managing their finances efficiently but are also crafted to aid in navigating through issues concerning late payments from clients. This is built on the understanding that consistent late payments can disrupt a freelancer's budget, necessitating strategic planning and guidelines.

- Emergency Fund: One smart tip is to always create an 'emergency fund'. Having a backup plan like an emergency fund can be helpful when late payments occur. This fund can support daily expenses and certain business needs while waiting for the client payments.

- Anticipate and Plan: Another vital tip is to anticipate late payments. If late payments are common with certain clients, this needs to be factored in while planning the budget. Advanced planning cushions the freelancer against potential financial strains associated with such late payments.

- Negotiating Advance Payments: This may not work with all clients, but negotiating coming to an agreement for an upfront partial payment before the onset of work can provide some financial stability and assurance.

Here's a simple table illustrating the aforementioned budgeting tips.

| Tip | Description | Results |

|---|---|---|

| Emergency Fund | Allocating a regular amount to an emergency fund. | Covers daily expenses during late payment periods. |

| Anticipating Late Payments | Mapping the habit of clients who make late payments and plan the budget accordingly. | Avoids financial strain during waiting periods. |

| Negotiating Advance Payments | Requesting a portion of the payment upfront before the onset of work. | Ensures financial stability and reduces reliance on timely payments. |

10. Are these tips useful for freelance entrepreneurs who are just starting out?

Advantages for Beginners

Undoubtedly, these budgeting tips offer immense value, particularly for freelance entrepreneurs venturing into the business world for the first time. Financial management can be challenging for novices, but with these tips, they can proficiently handle their finances.

- Efficient Expense Tracking: The tips provide guidance to rookies on how they can skillfully track their expenses, a fundamental aspect in business budgeting.

- Income Forecasting: By using these tips, beginners learn such important concepts like forecasting future income, which prevents overspending and fosters disciplined spending.

- Savings: For entrepreneurs just starting out, these tips educate on how to save and invest wisely, ensuring they constantly have an emergency fund to cushion them during lean times.

Changing Business Landscape

Amid the rapidly changing business context, these budgeting tips remain timely for freelance entrepreneurs, regardless of whether they're just starting out or not. Given the unpredictability of the freelance business - where income is not consistent - these tips help them remain afloat.

| Business Context | Budgeting Tip | Benefit |

|---|---|---|

| Uncertain income stream | Create and stick to your budget | Avoids overspending and promotes financial discipline |

| Rising business costs | Track your expenses | Provides clear picture of expenditure for cost-cutting |

| Unforeseen business challenges | Save for emergencies | Ensures financial security during tough times |

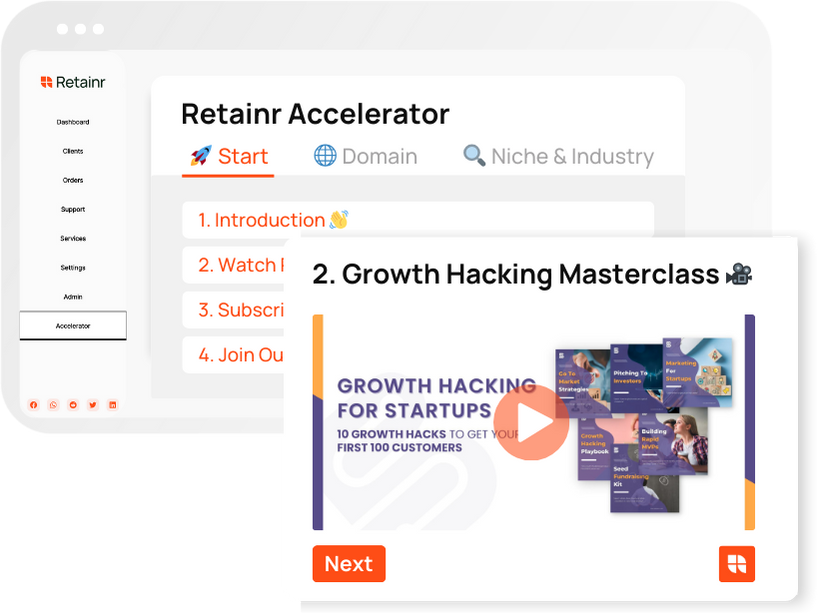

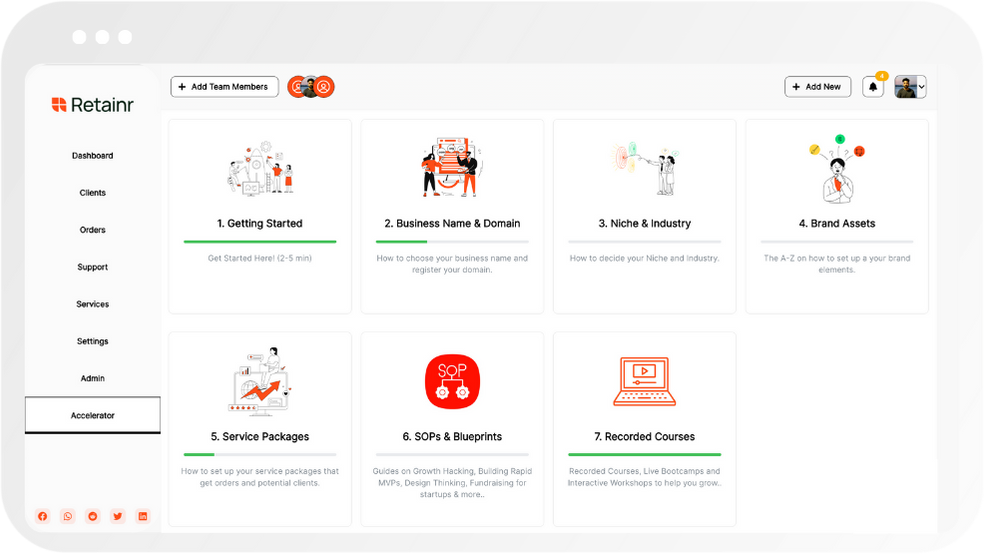

Boost Your Agency Growth

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)