7 Challenges Faced by Self-Employed Workers

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are the main challenges self-employed workers generally face?

Main Challenges Self-Employed Workers Face

The world of self-employment often appears as a desirable career path, offering unprecedented freedom and autonomy. However, there are also unique challenges that come with being your own boss and managing your business. In contrast to traditional employment, self-employed workers often juggle multiple roles and responsibilities that can add complexity to their day-to-day work life. Here are some of the main challenges self-employed individuals often encounter:

- Financial Instability: Without a consistent paycheck, income can fluctuate dramatically depending on the period and the type of work.

- Trouble in Getting Loans: Self-employed individuals may face difficulty in getting loans as they might not have a regular income source.

- Limited Benefits: Unlike traditional employees, the self-employed must fund their own healthcare, vacation time, and retirement savings.

- Tax Complications: Self-employed individuals are responsible for calculating and paying their own taxes, which can be complex and time-consuming.

- Lack of Support: Without coworkers or supervisors to rely on, self-employed workers may feel a lack of emotional and practical support.

- Work-Life Balance: Maintaining a healthy work-life balance can be difficult since the boundaries between work and personal life can get blurred.

- Professional Isolation: Working alone can lead to feelings of isolation and disconnection from professional communities.

Despite these hurdles, self-employment continues to be a sought-after mode of occupation for many. Each of these challenges offers a potential area for development, bringing opportunities for growth and resilience. As with any career path, knowledge and preparation can make all the difference in navigating these challenges.

| Challenges | Description |

|---|---|

| Financial Instability | Income can fluctuate dramatically depending on the period and the type of work. |

| Trouble in Getting Loans | Difficulty due to lack of regular income source. |

| Limited Benefits | Must fund own healthcare, vacation time, and retirement savings. |

| Tax Complications | Responsible for calculating and paying own taxes. |

| Lack of Support | Might feel lack of emotional and practical support. |

| Work-Life Balance | Maintaining a healthy balance might be difficult. |

| Professional Isolation | Working alone can lead to feelings of isolation. |

2. How can self-employed workers manage the challenge of unpredictable income?

Tackling the Challenge of Unpredictable Income

Self-employed workers often grapple with the unpredictability of their income, especially during initial stages. This can make financial planning challenging. However, by using effective strategies, it's possible for them to overcome this obstacle. Here are a few effective methods:

- Create a Budget: Determine projected income and note down all projected expenses. Always budget for the lowest projected income to ensure all essential expenses are covered.

- Emergency Fund: Have a reserve fund to cover expenses in times of financial turmoil or when income is significantly lower than projected.

- Diversify Income: Having more than one income source makes it easier to deal with unpredictable slowdowns.

Estimation of Expenses and Income for Self-employed Worker

It's essential for self-employed individuals to make accurate income and expense projections, to enable them to manage the financial oscillations that accompany self-employment efficiently. The following table demonstrates a simple way to estimate the monthly expenses and income:

| Month | Estimated Income | Estimated Expenses |

|---|---|---|

| January | $4000 | $3500 |

| February | $5000 | $3000 |

| March | $4500 | $2800 |

Developing a Financial Stability Plan

Self-employed workers can develop a sound financial stability plan to navigate through the uncertain times. The below points will help them in having a concrete financial path:

- Creating a buffer in the budget to account for volatility in income can be hugely beneficial.

- Investing in a good accounting software to track income and expenses, and anticipate future financial trajectory.

- Periodic review and adjustment of financial goals and expectations according to the business performance.

3. What strategies can be used to overcome the lack of benefits such as health care for self-employed workers?

Strategies to Overcome the Lack of Health Care Benefit

Healthcare is a significant challenge for self-employed individuals as they often shoulder higher costs than those employed by companies. To combat this, several approaches can be adopted:

- Purchasing Individual Health Insurance: This option involves paying directly for an independent plan, designed to cover single individuals. It may be costly but provides essential health care coverage.

- Joining Healthsharing Plans: These allow groups of self-employed people to come together, share risks, and cover each other's healthcare needs at a lower cost.

- Lowering Modified Adjusted Gross Income (MAGI): By doing so, self-employed individuals could qualify for premium tax credits, thus reducing their health insurance costs.

Creating a Self-Employed Benefits Package

In addition to the previous strategies, self-employed workers can create a benefits package tailored to their needs, as shown in the table below:

| Benefit | Description | How to Achieve |

|---|---|---|

| Health Insurance | Coverage for medical and surgical expenses | Purchase individual health insurance or join a healthsharing plan |

| Retirement Savings | Investment plans for post-working years | Open a Solo 401(k) or a SEP-IRA |

| Life Insurance | Coverage for death-related expenses | Purchase individual life insurance |

| Disability Insurance | Income supplement in case of injury or illness | Purchase individual disability insurance |

Utilizing Small Business Associations and Freelance Unions

A further method to offset the lack of benefits for self-employed individuals is to become a member of small business associations or freelance unions. These organizations often:

- Offer health insurance options to their members

- Provide resources for retirement savings

- Make other benefit options available

It's essential to explore these options and choose what suits best according to individual needs and factors such as age, health condition, and financial status.

4. Does being self-employed mean facing constant loneliness or isolation?

The Loneliness or Isolation Challenge in Self-Employment

One significant challenge faced by self-employed individuals is the potential for loneliness or isolation. This is particularly true for those who work from home, where there may be little to no interaction with others throughout the typical working day. While some people thrive in solitary environments, others may find it more difficult.

- Emotional Impact: The main consequence of isolation is its emotional impact. Feeling lonely can lead to stress, depression, and anxiety. These mental health issues, if not addressed, can significantly impact a person's productivity and overall well-being.

- Lack of Social Interaction: Workplaces often offer valuable social interaction that self-employed individuals may miss. Whether it's a friendly conversation with a colleague or brainstorming in a team meeting, these interactions can often help stimulate creativity and make work more enjoyable.

- Less Collaboration Opportunities: Self-employed individuals often have fewer opportunities for collaboration. While this promotes independent thinking, it also eliminates the chance to brainstorm ideas and solutions with others, which can sometimes lead to better or more creative output.

Overcoming Feelings of Loneliness or Isolation

Facing and overcoming the feelings of loneliness or isolation requires conscious efforts. Here are some steps to take:

| Steps to Overcome Loneliness | Description |

|---|---|

| Find a community | Join social groups or professional networks related to your field. This can help foster a sense of community and reduce feelings of isolation. |

| Co-working spaces | Co-working spaces offer a shared working environment that can often provide some level of social interaction. |

| Work-life Balance | Ensure to have hobbies, friends, and family outside of work to maintain a balance and have much-needed social interactions. |

| Seek professional help | Therapists and Counselors can provide strategies to combat feelings of loneliness and stress related to isolation. |

5. How do self-employed individuals manage their time effectively amidst different duties?

Effective Time Management for Self-Employed Workers

The key to effective time management for self-employed individuals lies in planning, prioritizing and remaining consistent. Establishing a routine that works, integrating productive habits and setting realistic deadlines is crucial. The challenge could be specified as maintaining a professional lifestyle while still performing tasks that traditionally are done by different departments in a typically structured company. For example, such responsibilities might include marketing, sales, customer service or even accounting.

Time Management Techniques

Adopting time management techniques like the following ones, have proved to be beneficial for self-employed individuals:

- The Eisenhower Box: This tool helps divide tasks into four categories- urgent and important, important but not urgent, urgent but not important, and neither urgent nor important. This helps the individual deal with critical activities and distinguish between what needs immediate attention and what doesn’t.

- The Pomodoro Technique: This involves breaking work into intervals, traditionally 25 minutes in length, separated by short breaks. These intervals are known as ‘Pomodoros’.

- Time Blocking: Here, individuals divide their day into blocks of time. Each block is dedicated to accomplishing a specific task or group of tasks and only those tasks.

Effective Tools for Time Management

To further aid in time management, several digital tools and software can be incorporated. Listed below are a few of them.

| Tool | Description |

|---|---|

| Google Calendar | An easy tool for scheduling your tasks and setting reminders for important deadlines. |

| Asana | A productivity tool that helps teams organize work and manage projects seamlessly. |

| Todoist | A task management app that helps individuals keep track of their tasks and projects. |

6. How can self-employed workers handle inconsistent workload and client management?

Handling Inconsistent Workload

In order to handle an inconsistent workload, self-employed workers need to have a well-established plan. The first solution is to save for the lean times. Setting aside a certain percentage of earnings during busier periods can provide a buffer during times with lesser work. Secondly, maintaining a disciplined work schedule can help, treating work-from-home as a regular job, setting fixed hours for work and breaks. Lastly, diversifying your client base can also contribute to income stability. Working with a variety of clients from different industries can cushion the impact when work slows down.

Client Management Techniques

Client management is another crucial part of a self-employed person’s daily agenda. It’s crucial to have a reliable system in order to manage client communication efficiently. This could involve using client management software or tools such as Trello, Asana or Basecamp. Secondly, establishing clear communication channels and expectations right from the start, helps in avoiding miscommunications. Finally, always providing professional service, ensures repeat business and referrals, which are vital for a self-employed worker.

Summary in Table Format

| Challenges | Solutions |

|---|---|

| Inconsistent Workload |

|

| Client Management |

|

7. What are the financial challenges typically faced by self-employed individuals?

Financial Inconsistencies

One of the most significant financial challenges faced by self-employed workers is the lack of a consistent income. Unlike traditional jobs that offer the stability of a regular paycheck, earnings can greatly fluctuate when you're self-employed. One month might bring in a hefty income, while another might be lean.

- Irregular income

- Income instability

Retirement and Benefits

Another financial hurdle comes in the form of saving for retirement and funding benefits. Since they do not work for a company which might automatically deduct pension contributions or offer health care benefits, they need to take care of these aspects themselves.

| Benefit | Details |

|---|---|

| Health Care | Self-employed workers must provide their own health insurance, often at a high cost. |

| Retirement | Unlike employees who have retirement contributions automatically deducted, self-employed individuals must arrange and manage these funds on their own. |

Tax Obligations

Coping with tax obligations is another financial challenge for self-employed individuals. They are responsible for paying all of their Social Security and Medicare taxes, which can be quite a burden without a company sharing the cost. Figuring out how much to set aside for taxes can also be a confusing process for the self-employed.

- Higher tax burden

- Complex tax calculations

8. How significant is the challenge of maintaining a good work-life balance for self-employed workers?

The Importance of Work-Life Balance for Self-employed Workers

One of the biggest challenges faced by self-employed workers is striking the right balance between their professional and personal lives. They operate in a work environment that lacks clear boundaries – they generally don’t have set office hours and their workplaces often overlap with their personal spaces. This makes it unusually difficult for them to separate work from other aspects of their lives, leading to stress and burnout. The following points highlight why work-life balance is crucial:

- Improves Productivity: A proper work-life balance ensures enough rest and recreation, which in turn increases energy and productivity at work.

- Prevents Burnout: When work bleeds into personal time, it could lead to exhaustion and stress, resulting in burnout. A balanced lifestyle helps avoid this.

- Enhances Health and Well-being: Continuous, prolonged work can affect mental and physical health. Recreation and downtime help rejuvenate the body and mind.

How to Maintain a Good Work-Life Balance

Managing a proper work-life balance as a self-employed worker does not come easily. However, employing specific strategies can significantly improve this balance and contribute to overall well-being. Here are some tips:

- Set a schedule: Implementing a fixed work schedule helps divide professional and personal time effectively.

- Take breaks: Short breaks during work hours can increase concentration and prevent fatigue.

- Set boundaries: Clearly defined boundaries regarding work hours and workspace can help manage work efficiently without encroaching on personal time.

Work-Life Balance Statistics

Survey data below illustrates how self-employed workers perceive their work-life balance:

| Survey Question | Percentage |

|---|---|

| Self-employed workers who regularly feel stressed due to work | 45% |

| Self-employed individuals who have a good work-life balance | 53% |

| Self-employed individuals who struggle to establish a schedule | 41% |

9. What are some common taxation issues faced by self-employed workers and how can they be tackled?

Common Taxation Issues Faced by Self-Employed Workers

Being self-employed can significantly escalate the complexity of tax affairs. This is due, in part, to the various tax obligations one must fulfill, which can quickly compound into a burdensome task, especially if inadequately prepared. A few of the most common taxation issues faced by self-employed workers include:

- Difficulties in Understanding Tax Deductions: Self-employed individuals can claim a wide range of expenses, but understanding what qualifies can be confusing.

- Irregular Income: Unlike conventional employees, self-employed workers’ income can fluctuate, complicating income projections and tax estimation.

- Self-Employment Tax: In addition to income tax, the self-employed must pay 'self-employment tax', which encompasses Medicare and Social Security taxes.

- Quarterly Tax Payments: Rather than having taxes automatically withheld from their salary, self-employed individuals typically need to make estimated tax payments every quarter.

Solutions to Common Taxation Issues

Although these issues can be overwhelming, there are strategies self-employed workers can employ to mitigate these problems:

| Tax Issue | Solution |

|---|---|

| Understanding Tax Deductions | Consult a certified tax professional or use tax software to understand what expenses can be claimed. |

| Irregular income | Keep meticulous track of your income and expenses throughout the year for a more accurate income estimate. |

| Self-employment tax | Deduct the employer-equivalent portion of your self-employment tax in computing your adjusted gross income. |

| Quarterly tax payments | Set aside a percentage of your income regularly to avoid surprises when tax payment deadlines arrive. |

Conclusion

While it's true that self-employment brings with it a unique set of tax challenges, effectively managing these issues is more than possible with the right preparation and assistance. Understanding these potential issues and how to address them can significantly simplify the tax filing process, leaving you more time to focus on what truly matters – your business.

10. How can self-employed workers secure their retirement as they don't have access to employer-sponsored retirement plans?

Challenges for Self-Employed Retirement Plans

Self-employed workers often face a significant challenge when it comes to securing their retirement. Unlike those with traditional employment, they don't benefit from employer-sponsored retirement plans - this means they must take extra steps to ensure their financial stability in their later years. Here are three key challenges they often face:

- Lack of automatic deductions: Self-employed individuals are solely responsible for setting aside funds for retirement, and without the convenience of automatic payroll deductions, it can be a more challenging process.

- Volatility of income: With income that may fluctuate significantly from month to month, it can be challenging for self-employed individuals to establish a consistent savings schedule for retirement.

- No employer match: Traditional employees often benefit from employer matches to their retirement contributions, a perk not available to self-employed workers.

Solutions for Self-Employed Retirement Planning

Despite the challenges, there are several strategies self-employed workers can adopt to secure their retirement. The following table illustrates potential options:

| Plan | Description |

|---|---|

| Solo 401(k) | An individual 401(k), designed for business owners with no employees. Allows for higher contributions than more traditional retirement plans. |

| SEP IRA | A Simplified Employee Pension Individual Retirement Account, which allows self-employed individuals to contribute a portion of their net earnings to their retirement savings. |

| Savings Incentive Match Plan for Employees (SIMPLE) IRA | Allows small businesses and self-employed individuals to make contributions to their employees’ retirement savings. |

Importance of Self-Directed Planning

While these plans offer a good starting point, it's up to the self-employed worker to take control of their retirement planning. This includes:

- Regularly reviewing and updating retirement plans to reflect changes in income, personal circumstances, and retirement goals.

- Working with a financial advisor to help navigate the complexities of self-employed retirement planning.

- Investing wisely and diversifying to minimize risk.

Ensuring a secure retirement as a self-employed individual may be more complex, but with proactive planning, it's certainly achievable.

Conclusion

Summary of Key Challenges for Self-Employed Workers

Being one's own boss is empowering, however, self-employment has its fair share of challenges. Here are the seven most common issues self-employed workers face:

1. Uncertain Income

Income instability is a significant challenge because earnings often fluctuate from month-to-month. Successful planning and saving are crucial to overcoming this predicament.

2. Landing Clients

Securing consistent work can be difficult, especially in the early days of self-employment. Persistently marketing yourself to attract the right clients is key.

3. Time Management

Juggling multiple tasks and deadlines can be daunting. Develop effective time management skills to stay on top of your work schedule.

4. Handling All Business Aspects

The self-employed need to handle all business facets including sales, marketing, customer service, and accounting, often without external support.

5. Lack of Benefits

Unlike traditional employment, self-employed individuals must arrange their own benefits, such as health insurance, paid time off, and retirement savings.

6. Tax complications

Self-employment taxes can be complex and time-consuming. Proper documentation, organization and understanding tax laws are necessary for compliance.

7. Work-Life Balance

Blurring boundaries between work and personal time can lead to burnout. It’s important to set clear work-life boundaries for balanced living.

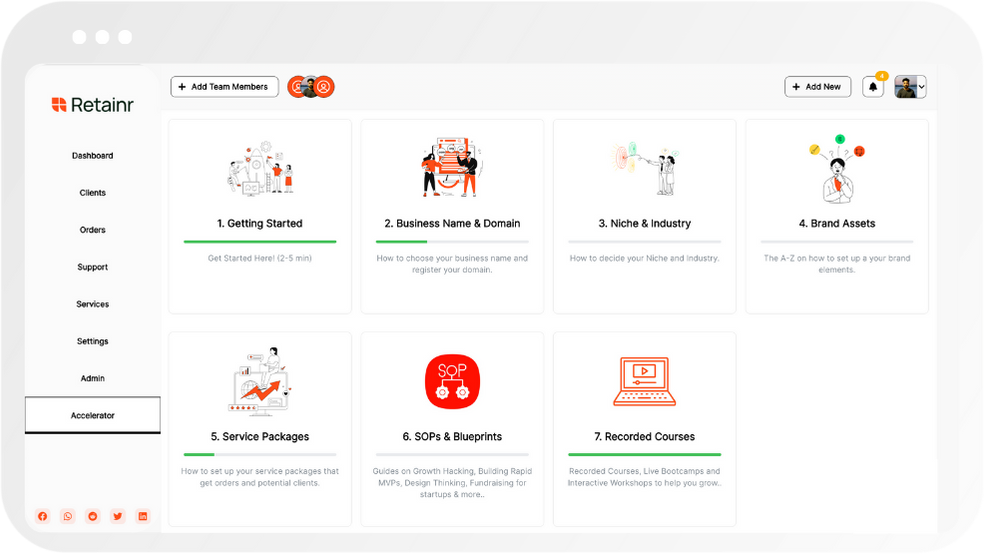

Retainr.io: The Ideal Solution for Self-Employed Professionals

Navigating these challenges can be tricky. However, with the right tools, self-employment becomes significantly easier. Enter Retainr.io. This powerful software is designed to help self-employed individuals manage clients, orders, and payments seamlessly.

Whether you're struggling with acquiring clients, time management, or handling all aspects of your business, Retainr.io provides effective solutions. This software tools makes it easier to track client history and interactions, manage orders, process payments and streamline your overall workflow.

It's more than just a management tool - it's a comprehensive platform built for your business success. It's time we change how we approach self-employment. Armed with Retainr.io, you'll be better equipped to meet the challenges head on and thrive as a self-employed professional.

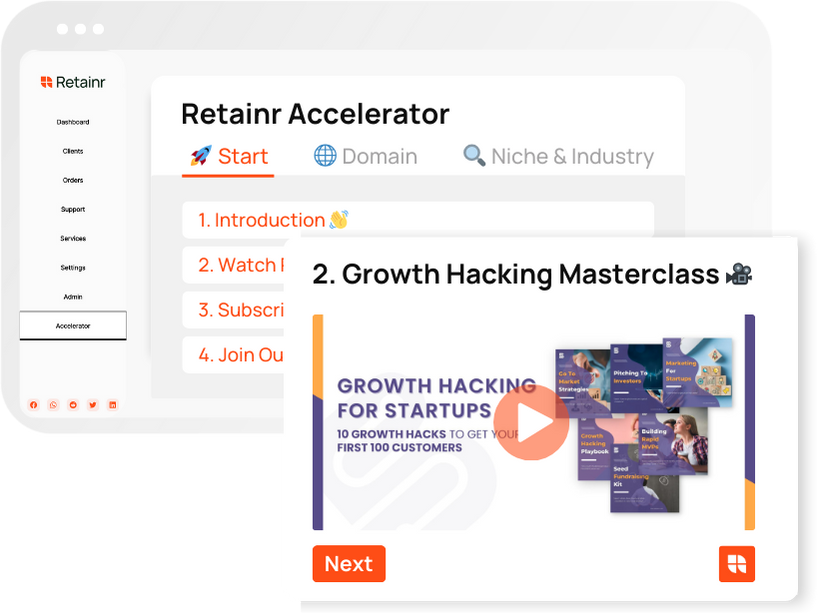

Boost Your Agency Growth

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)